🚀 全新 AI 外贸工具,轻松拓展优质客户!拓展客户从未如此简单高效!我们隆重推出 AI 外贸工具,为您提供以下核心支持:

💡 机会不等人,立即行动! 👉 添加微信了解更多: 📱 微信号:1️⃣3️⃣0️⃣7️⃣0️⃣2️⃣7️⃣2️⃣2️⃣5️⃣6️⃣ 立即体验,解锁全新增长方式! 祝商祺 |

Wednesday, February 26, 2025

🚀 全新 AI 外贸工具,轻松拓展优质客户!

🚀 全新 AI 外贸工具,轻松拓展优质客户!

🚀 全新 AI 外贸工具,轻松拓展优质客户!拓展客户从未如此简单高效!我们隆重推出 AI 外贸工具,为您提供以下核心支持:

💡 机会不等人,立即行动! 👉 添加微信了解更多: 📱 微信号:1️⃣3️⃣0️⃣7️⃣0️⃣2️⃣7️⃣2️⃣2️⃣5️⃣6️⃣ 立即体验,解锁全新增长方式! 祝商祺 |

Sunday, February 23, 2025

离职证明需要写哪些内容?

员工社保未处理好,将为企业带来八大难题!

1. 责令限期缴纳:社保行政部门会要求单位在规定期限内补缴社保费用。

2. 滞纳金:逾期不缴纳的,按日加收万分之五的滞纳金。

3. 罚款:对直接责任人员处500元以上3000元以下罚款。

4. 强制执行:逾期仍未缴纳的,社保机构可申请法院强制执行。

5. 员工索赔:员工可要求单位赔偿因未缴社保造成的损失,如医疗费用、养老金等。

6. 行政处罚:情节严重的,可能面临更高罚款或其他行政处罚。

7. 信用影响:违法行为可能被记入信用档案,影响单位信誉。

8. 刑事责任:情节特别严重的,可能追究刑事责任。

如何规避?企安给出3点建议

① 签自动放弃缴纳社保的协议;

② 工资表要有社保补贴,且员工签字;

③ 购买雇主责任险,规避工伤赔偿。

企安----让中国民营企业经营更安全!

让企业打赢劳动官司的用工风险管控十大系统

1、劳动关系管控

2、招聘入职管控

3、工资管理管控

4、社会保险管控

5、劳动争议管控

6、奖惩制度管控

7、考勤制度管控

8、工伤处理管控

9、离职程序管控

10、员工关系管控

企安咨询为您一站式解决企业用工风险,为您的企业保驾护航!

我们讲座主讲内容:

【1】劳动合同条款设计如何对企业有利?比如调岗,调薪,调整工作时间和地址,以及如何解决一些疑难问题(虚构病假,消极怠工等)

【2】规章制的完善?规章制度如何得到法院认可,处理员工不担心法律风险,员工给公司造成损失能够要求赔偿等

【3】社保未买,社保有税务征收,如何降低成本和规避风险?如员工投诉补缴社保,社保稽查等。

【4】员工自己要求不卖社保,但发生不愉快的时候就要求企业补缴或者赔偿?

【5】工伤处理?如何预防工伤,出现工伤的处理流程和技巧。

【6】员工不服从安排,消极怠工,想处理担心被告?

【7】员工发生工伤或者请病假,一直不来企业上班,又不敢解除?

本次讲座是不增加企业管理难度和成本的情况下,去规避用工的法律风险,围绕着企业将来能打赢劳动官司的角度设计"劳动合同,规章制度,考勤表,工资条,社保,工伤赔偿协议,离职手续等"帮助企业能够安全,稳健的经营和发展。

【参课注意事项】

参课对象:董事长、法人、股东、总经理、企业负责人( 敏感课题勿派其他人员参加)

学习费用:全国统一680元/位(含中餐费、场地费、资料费)

参课时间地址:填表后,客服第一时间与您联系

近期全国开课时间表:

2月17日 北京

2月18日 广州

2月19日 济南

2月20日 郑州

2月21日 温州

2月22日 西安

2月23日 上海

2月24日 东莞、南京

2月25日 佛山

2月28日 深圳

报名方式:

1、联系专属客服:13928826727 林峰老师

2、在线预约链接:https://jinshuju.net/f/crDDFo

3、如您需要个性化方案,可选择上门入企调研项目,一对一了解贵司的问题及解决方法!原价19800元/家,现优惠政策仅需要1980元/家,可在填表时选择上门入企调研

退订回T

Friday, February 21, 2025

Unlocking Crypto Mastery: Insider Lessons from 7 Years in the Crypto World

The crypto market is as unpredictable as it is exhilarating. Whether you're a seasoned investor or just stepping into this brave new world, understanding its underlying dynamics can mean the difference between striking gold and facing a hard fall. Drawing on over seven years of hands-on experience, this guide distills hard-won lessons into a clear, practical roadmap for success.

In this article, we'll cover:

- Self-Assessment & Cash Flow Mastery: Discover your investor profile.

- Decoding the Crypto Market Cycle: Learn to identify the four key phases.

- Tokenomics & FOMO Control: Become a tokenomics expert and manage your emotional investing.

- Building Your Competitive Edge: Harness the power of social media and community.

Let's dive into the insights that can transform your approach to crypto investing.

1. Know Thyself: The Foundation of Smart Investing

Before you put a single dollar into crypto, take a hard look at your financial situation and risk appetite. The first step is to understand your personal investor profile. Ask yourself:

- What are my monthly income and fixed expenses (rent, mortgage, bills)?

- How much discretionary money do I have for investing versus enjoying life?

- Am I a young professional with fewer obligations or a family-oriented investor with long-term commitments?

A simple cash flow breakdown can be a game changer:

This flowchart helps you visualize the process of assessing your cash flow to decide how much capital you can comfortably risk in the crypto market.

2. The Crypto Market Cycle: From Accumulation to Markdown

Understanding the cyclical nature of the crypto market is essential. The market typically moves through four distinct phases:

- Accumulation Phase

At this stage, market sentiment is low. Prices have bottomed out, and only a few early believers are buying. This is the time when the foundations for the next bull run are being laid. - Markup Phase

As new technologies and innovations emerge — often fueled by institutional interest and positive regulatory shifts — the market experiences a surge. Expectations soar as hype builds up around major news such as ETF approvals or breakthrough partnerships. - Distribution Phase

Here, the bubble starts to deflate. Despite lingering optimism, the market shows signs of overextension. Prices reach unsustainable levels, and early investors begin to cash out. - Markdown Phase

Finally, reality sets in. Overinflated expectations come crashing down, leading to significant sell-offs. This phase paves the way for a fresh start in the next accumulation period.

To illustrate, consider this state diagram that maps the journey:

Understanding where the market stands within this cycle helps you make smarter entry and exit decisions. It also clarifies why "holding forever" isn't always the best strategy — sometimes, it's wiser to take profits as the hype peaks.

3. Mastering Tokenomics & Taming FOMO

Become a Tokenomics Expert

Tokenomics is the lifeblood of crypto investing. Every token has its own economic model — supply, distribution mechanisms, utility, and demand drivers. Many investors lose money simply because they haven't dug deep enough into these details. For example, projects that reached all-time highs only to plummet in value often did so because investors failed to understand their underlying tokenomics.

Key takeaway:

Study the structure of each token and how it influences its market behavior. Become proficient at analyzing token supply, emission schedules, and demand curves.

Control Your FOMO (Fear of Missing Out)

Crypto markets are notorious for their emotional swings. Social media buzz and sensational headlines can create a fear of missing out, leading to rash decisions. The advice here is clear: avoid buying the dip with the expectation of an endless drop. Instead, set realistic entry points and stick to a disciplined strategy — even if that means paying a bit more for quality assets when the market is hot.

4. Building Your Competitive Edge: The Power of Information

In the world of crypto, timing is everything. Gaining an edge over the competition means staying ahead of the curve by leveraging social media and specialized tools. Here are some practical tips:

- Twitter as Your Information Hub:

Instead of passively scrolling through endless feeds, use Twitter Pro's list functionality to follow key influencers, early project discoverers, and seasoned analysts. Create custom lists to filter noise and capture only the most relevant updates. - Utilize Crypto Research Tools:

Platforms like Dex Screener and DeFi Llama offer invaluable insights into token volume, liquidity, and trends. These tools help you track projects that are gaining traction before they hit mainstream awareness. - Join a Community:

Whether it's a private group like Agora or any other vibrant crypto community, surrounding yourself with informed peers is crucial. Sharing ideas and experiences not only accelerates your learning curve but also shields you from making isolated mistakes.

Invest with Confidence and Curiosity

Crypto investing is not just about chasing the next big win — it's about developing a nuanced understanding of a rapidly evolving market. By knowing your financial profile, mastering market cycles, delving deep into tokenomics, and arming yourself with timely information, you set yourself on the path to sustainable success.

What steps will you take today to refine your crypto strategy? Join the conversation — share your thoughts, questions, and experiences in the comments below. Remember, every smart investor was once a curious beginner.

source: https://raglup.medium.com/unlocking-crypto-mastery-insider-lessons-from-7-years-in-the-crypto-world-bdb7a81ea53a?source=rss-f56f44caad34------2

Tuesday, February 18, 2025

会员客户您好,麻烦您收到回复一下

今晚的私域直播课是由央企及大型集团公司资深财务咨询老师为您分享

1.金税四期下,如何化解历史原罪?老板和财务如何应对?

2.新老公司走向,如何保住健康的现金流

3.税收筹划怎么做? 增值税、企业所得税、合法安全降低税收成本

4.倒查30年的底线?企业被倒查触碰的税务红线?

5.新《公司法》下:法人/董事/监事风险如何规避?

6.金税四期系统大数据比对【财务数据】预警,民企应对策略?

7.防火墙公司如何设计?如何多层持股,降低老板风险?

8.金税四期下:个人卡流水大、居间费、缺发票的合规处理?

9.家族、集团、控股、海南、香港公司间控股关系、及实操利弊

⏰今晚19:30-21:30

课程入口:回复“1”领取课程链接

这是针对您购买的资料赠送的私域直播课,全程直播没有回放,您一定要预留好时间学习

课后免费附赠《企业财税工具包》包含:财务常用文件,各行业节税方案,企业财税合规方案,大额公转私合规方案等

其他学习方式:

1.添加老师助理微信:16719474883

2.点击链接报名参加:https://jsj.top/f/brHN7o

Monday, February 17, 2025

7 Expert Tips to Dodge the Deadly Crypto Trading Pitfalls

Have you ever experienced that rush when your crypto portfolio hits an all-time high — only to see those gains vanish as quickly as they appeared? In the volatile world of cryptocurrency, it's easy to be seduced by the numbers on the screen. But those dazzling gains can be nothing more than illusions if not managed properly. This article explores the psychological traps and common mistakes many traders fall into, offering seven essential tips to help you safeguard your capital and trade smarter.

The Euphoria That Sets You Up for Failure

Imagine this: your portfolio is ablaze with green, your ATH (All-Time High) shimmers on the screen, and you feel unstoppable. The temptation to capture that moment and share it with friends is overwhelming. However, what you see isn't liquid cash. Once you factor in trading fees, commissions, and taxes, those soaring numbers shrink dramatically. This false sense of security often leads traders to:

- Overestimate their gains: Believing that digital numbers translate directly into real profits.

- Fall into overconfidence: Assuming that winning streaks will continue indefinitely.

- Engage in impulsive trading: Rotating tokens without a clear strategy.

- Succumb to revenge trading: Risking more capital in a desperate bid to recover losses.

Before diving into the top tips, let's visualize the decision-making process that often traps investors.

Visualizing the Decision: When to Take Profits

Below is a chart that captures the essential steps an investor should consider when faced with an ATH scenario:

Top 7 Expert Crypto Trading Tips

1. Recognize the Illusion of Your ATH

Your portfolio's ATH is a milestone — not actual cash in hand. Trading fees, withdrawal commissions, and taxes can significantly reduce what appears to be a hefty profit. Accepting this fact is crucial to avoid overconfidence and the subsequent traps it brings.

2. Embrace Non-Linear Growth

It's a common misconception to believe that a winning streak will continue at a steady, linear rate. Markets are cyclical; even assets like Bitcoin have experienced sharp 70% corrections within weeks. Adjust your expectations, diversify your investments, and plan for inevitable downturns.

3. Develop a Profit-Taking Strategy

Waiting for that mythical "perfect" exit point is a recipe for disaster. Instead, set clear, predetermined exit points before you even enter a trade. By taking profits periodically, you secure gains and build a robust base for reinvestment — regardless of where the market heads next.

4. Be Wary of Blindly Buying the Dip

Buying the dip can be enticing — after all, a 20%, 30%, or even 50% drop might seem like an opportunity to scoop up discounted assets. However, a dip might signal the beginning of a deeper decline rather than a temporary setback. Evaluate the token's fundamentals and market context before committing additional capital.

5. Resist the Urge to Overtrade

In a bullish market, the lure of rotating tokens to chase even higher returns is strong. Yet, overtrading often results in diminishing returns. Instead of constantly swapping high-performing tokens for lower-cap alternatives, focus on projects with solid fundamentals and take gradual profits.

6. Avoid Revenge Trading

Revenge trading is an emotionally charged mistake — when losses trigger a desperate desire to "win back" what was lost. This approach leads to riskier bets and can compound your losses. Recognize these emotional triggers, pause, and reassess your strategy rather than rushing back into the fray.

7. Control Your Emotions with a Structured Plan

Crypto trading isn't just about numbers — it's a psychological battleground. Developing and adhering to a detailed trading plan that includes entry/exit strategies and risk management protocols is essential. This structure helps mitigate the powerful forces of FOMO, greed, and fear that can otherwise derail your decisions.

Conclusion: Build Discipline to Secure Lasting Wealth

The key takeaway is simple: discipline and strategy are paramount in the volatile world of crypto trading. By understanding that the gleaming numbers on your screen are ephemeral, and by taking profits methodically, you pave the way for long-term success. Avoid the pitfalls of waiting for perfection, overtrading, and revenge trading. Instead, take control of your emotions, trust your well-laid strategy, and adapt to shifting market conditions.

What challenges have you faced on your crypto journey? Do you have any additional tips or strategies that have worked for you? Share your thoughts in the comments below — your experience could be the key to helping another trader navigate this complex landscape.

source: https://raglup.medium.com/7-expert-tips-to-dodge-the-deadly-crypto-trading-pitfalls-64e47393c9df?source=rss-f56f44caad34------2

Saturday, February 15, 2025

Unleashing AI Agents: The 2025 Crypto Revolution You Can’t Ignore

In the fast-evolving world of technology, AI Agents are emerging as the game-changer in both our daily lives and the crypto ecosystem. Far from being a distant sci‑fi fantasy, these intelligent executors are already automating complex tasks — from managing job applications to executing seamless DeFi operations. As we stand on the brink of a new era in 2025, this article delves deep into the transformative potential of AI agents, exploring their functionality, the different types, and the investment opportunities they present in the blockchain space.

What Are AI Agents?

At their core, AI agents are the executors of artificial intelligence. While traditional AI (like ChatGPT) serves as the "brain" that processes and provides information, AI agents are the "hands" that transform that knowledge into actionable results. Imagine handing over your résumé to a bot that not only scans for the best job openings but also applies to multiple vacancies on your behalf — all automatically. This seamless transformation from thought to action is the essence of AI agents.

The Convergence of AI and Blockchain

The integration of AI agents into the blockchain realm is creating unprecedented opportunities in the crypto market. With the global market cap for AI agent-related tokens hovering around $14 billion, these technologies are still in their infancy relative to giants like Bitcoin or Ethereum. Yet, their potential for growth is enormous.

Consider the scenario where an AI agent handles the entire process of converting Bitcoin to Ethereum and depositing it into your wallet using the most efficient decentralized platforms. This is not merely a hypothetical concept — it's already being developed and refined.

Categories of AI Agents in Crypto

The video script outlines several types of AI agents, each targeting a different niche within the crypto ecosystem:

- Infrastructure Agents

These projects provide the backbone for AI operations on blockchain platforms. Examples include frameworks and launchpads like Virtuals Protocol, which enables users to create and launch their own AI agents. - Influencer Agents

Designed to engage with communities, these agents (e.g., the crypto influencer ixbt) manage social media accounts, provide financial advice, and generate market buzz. While they can drive short-term speculative gains, caution is advised as many of these tokens may lose value over the long term. - Investment DAOs

These are AI-managed funds that automate investment decisions by analyzing market sentiment and executing trades based on real-time data. They promise to streamline portfolio management by reducing human error. - Utility Agents

Focused on automating practical tasks, these agents can execute functions ranging from trading and staking to complex operations in DeFi ecosystems. Their utility lies in the fact that while the underlying product may be sound, the token value is often driven by market sentiment rather than intrinsic functionality.

Tip for Readers: When evaluating these tokens, always perform in-depth research into tokenomics, utility, and market cap comparisons to distinguish between sustainable projects and speculative bubbles.

Tools and Resources for the AI Agent Ecosystem

For those eager to dive deeper into this revolution, several platforms offer invaluable insights and data:

- AI Agents Directory — A comprehensive landscape of current AI agents.

- Cookie.fun — Track the latest developments and market cap data.

- AI Agent Toolkit — Tools and resources to build and deploy your own AI agents.

- CryptoHunt MemeSearch — Explore trends and narratives in crypto.

- Elizas World — Discover the open-source framework behind many AI agent innovations.

How AI Agents Operate in DeFi: A Step-by-Step Flow

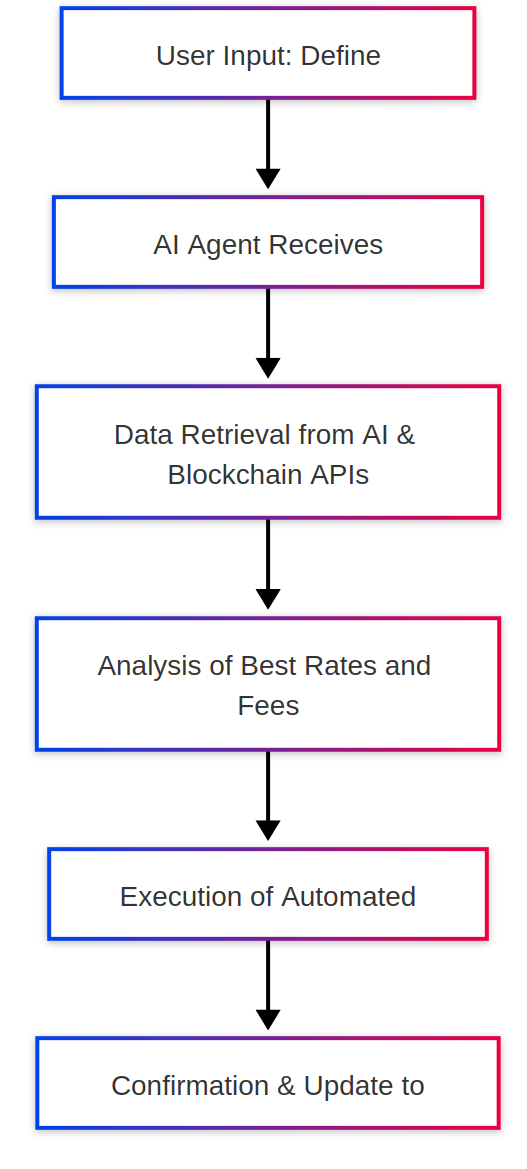

To demystify the process, consider the following flowchart that outlines how an AI agent can automate a DeFi transaction:

This simple diagram illustrates the process — from receiving the initial command to executing the transaction — highlighting the efficiency and precision of AI-driven automation.

Investment Insights and Future Outlook

While the promise of AI agents is undeniable, the landscape is complex and filled with both opportunities and risks. The video emphasizes a speculative approach in the early days:

- Short-Term Speculation: Tokens linked to influencer agents might soar due to market hype but could crash once the novelty fades.

- Long-Term Sustainability: Infrastructure projects and utility agents are likely to yield more reliable returns as they underpin critical blockchain operations.

The key takeaway is to adopt a cautious yet proactive approach. Engage in thorough research, consider short-term gains versus long-term viability, and always remain updated with the rapid innovations in this sector.

Conclusion

AI agents are not just an emerging trend — they represent a fundamental shift in how technology, finance, and daily tasks intertwine. As 2025 unfolds, their influence will likely redefine the crypto landscape, driving innovation and investment opportunities to new heights.

Are you ready to explore this brave new world? Which type of AI agent excites you the most — the high-octane influencer bots or the robust, long-term infrastructure projects? Share your thoughts and join the conversation in the comments below!

source: https://raglup.medium.com/unleashing-ai-agents-the-2025-crypto-revolution-you-cant-ignore-ed3b2bbbb5c1?source=rss-f56f44caad34------2

5513 Interesting News

- After 50 years, Wole Soyinka has returned to fiction

- Damn-Vulnerable-Drone - An Intentionally Vulnerable Drone Hacking Simulator Based On The Popular ArduPilot/MAVLink Architecture, Providing A Realistic Environment For Hands-On Drone Hacking

- Spirit's woes reveal the dismal state of America's budget airlines

- OpenAI rejects $97.4bn Musk bid and says company is not for sale

- Why Iranian dissidents love Cyrus, an ancient Persian king

- Inside the chaos machine of British politics

- South Korea's suicide rate fell for years. Women are driving it up again

- Business

- At 70, the global convention on refugees is needed more than ever

- Obituary: Anwar Congo died on October 25th

- European regulators are about to become more political

- Jiang Zemin oversaw a wave of economic change, but not much political reform

- This week's covers

- Trump's FBI Pick Kash Patel Took Up to $5M in Stock From Chinese Ecommerce Giant Shein

- Israel and Hizbullah play with fire

- This week's covers

- AI scientists are producing new theories of how the brain learns

- Polarisation by education is remaking American politics

- KAL's cartoon

- Only connect

- Booming cocaine production suggests the war on drugs has failed

- A job ad for Y Combinator startup Firecrawl seeks to hire an AI agent for $15K a year

- Jair Bolsonaro is barred from office for eight years

- Closing factories will not be enough to save Volkswagen

- Obituary: Abu Bakr al-Baghdadi died on October 26th

- Five charts show how Trump won the election

- Gemini Advanced can now recall your past conversations to inform its responses

- What Is Blockchain? The Complete WIRED Guide

- Economic data, commodities and markets

- European millionaires seek a safe harbour from populism

- CaixaBank's CFO Sees Case for Dealmaking Among Europe's Banks

- 'Who is Trump to decide our fate?': takeover threat adds to uncertainty in Gaza

- Ukraine is digging in as the Kremlin steps up its offensive

- Tesla faces an identity crisis: carmaker or tech firm?

- Scientists want to fix tooth decay with stem cells

- Arabica Coffee Prices Hit Record on U.S., Colombia Tariff Spat

- In 2021 our writers considered technology, meritocracy and the trans debate

- Obituary: Clive Sinclair foresaw the future too soon

- Opinion polls underestimated Donald Trump again

- Augmented reality offers a safer driving experience

- A comical effort by China's intelligence agency

- The killing of a Russian general shows Ukraine's spies remain lethal

- The race to prevent satellite Armageddon

- Broken promises, energy shortages and covid-19 will hamper COP26

- Britain's justice system has responded forcefully to the riots

- Gazans are rapidly losing access to the internet

- The ticking bomb under Canada's constitution

- How to hold armed police to account in Britain

- What should companies do to keep bosses safe?

- Democrats struggle to limit the loss of black voters in Georgia

- Jay Pasachoff travelled the world to catch the Moon eclipsing the Sun

- Britain's review body for criminal convictions is struggling

- Economic data, commodities and markets

- A typhoon hits Shanghai and the Chinese economy groans

- Economic and financial indicators

- This week's cover

- New Zealand and the Cook Islands fall out over China

- The plight of Brazil's indigenous groups worsens

- Radio telescopes could spot asteroids with unprecedented detail

- Why AI needs to learn new languages

- Colin Huang, China's richest man

- What does Modi 3.0 look like?

- Marco Rubio will find China is hard to beat in Latin America

- This week's cover

- Meta confirms 'Project Waterworth,' a global subsea cable project spanning 50,000 kilometers

- Alexei Navalny didn't just defy Putin—he showed up his depravity

- Sources and acknowledgments

- Rule by law, with Chinese characteristics

- Henry Kissinger and Eric Schmidt take on AI

- Japan's sleepy companies still need more reform

- Can Google or Huawei stymie Apple's march towards $4trn?

- Inside the unrest disfiguring English cities

- Business

- The end of cricket's Indian monopoly

- Politics

- Self-Driving Cars: The Complete Guide

- Elon Musk's DOGE Is Working on a Custom Chatbot Called GSAi

- Beijing Signals Readiness to Talk to Trump's Team, Even Old Foes

- Economic data, commodities and markets

- The booze industry reveals a lot about Kenya

- Schools in rich countries are making poor progress

- Huge floods in Brazil's south are a harbinger of disasters to come

- Two women are vying to be Mexico's next president

- Why people over the age of 55 are the new problem generation

- AI can predict tipping points before they happen

- This week's covers

- This week's cover

- Divorce in the rich world is getting less nasty

- The old have come to dominate American politics

- Machine translation is almost a solved problem

- Can Big Oil run in reverse?

- How China's communists fell in love with privatisation

- Many countries are seeing a revival of industrial policy

- US lawmakers respond to the UK's Apple encryption backdoor request

- Diplomats in Munich Fear Trump Is Giving Up Leverage to Putin Before Talks With Ukraine

- The 'new China' in Thailand: 'if you want hope, you have to leave' – video

- Foreign investors are rejecting Indian stocks

- Political theorists have been worrying about mob rule for 2,000 years

- The energy transition could make India even more unequal

- How Ukrainian farmers are using the cover of war to escape taxes

- Economic data, commodities and markets

- Sir Brian Urquhart died on January 2nd

- A crisis in prisons gives Britain's new government its first test

- George Shultz died on February 6th

- Can India's garments industry benefit from Bangladesh's turmoil?

- Why you should repay your mortgage early

- England's school reforms are earning fans abroad

- Battles over streaming break out for video games

- Spain's government marks 50 years since Franco died

- Diplomacy has changed more than most professions during the pandemic

- Baby-boomers are loaded. Why are they so stingy?

- Costly food and energy are fostering global unrest

- Britain's boom in public inquiries into past disasters

- China's WeRide Wants to Build Global Robotaxi Empire

- Trump and Vance are courting Europe's far right to spread their political gospel

- Mexico's mighty diaspora punches below its weight in elections

- Footage shows plane with 64 onboard colliding with helicopter near Washington DC - video

- A new way to predict ship-killing rogue waves

- Economic data, commodities and markets

- The Taliban is removing every shred of freedom from women

- How to fix palliative care in Britain

- Leon Fleisher died on August 2nd

- Business

- How Russia has revived NATO

- How the hard right both reflects and creates prejudice

- China's markets take a fresh beating

- Is Kamala Harris "brat"?

- Apple will introduce its 'newest member of the family' on February 19

- Korea Zinc Shares Rally After Adopting New Investor Protection Rules

- This week's covers

- The pandemic is plunging millions back into extreme poverty

- Ukrainians are settling down in Britain. That creates a problem

- Tech, Media & Telecom Roundup: Market Talk

- Russians have emigrated in huge numbers since the war in Ukraine

- Kamala Harris leads Donald Trump in our nationwide poll tracker

- The end of oil, then and now

- Natural Gas Falls on Shifting Weather Forecasts

- Why chinstrap penguins sleep thousands of times a day

- Climate change and the next administration

- China is using an "anaconda strategy" to squeeze Taiwan

- Young Latin Americans are unusually open to autocrats

- Yahya Sinwar made Hamas his own fief

- KAL's cartoon

- What to watch for on election night, and beyond

- Disinformation is on the rise. How does it work?

- Fighting the war in Ukraine on the electromagnetic spectrum

- AI wins big at the Nobels

- A clue to China's true covid-19 death toll

- Policymakers are likely to jettison their 2% inflation targets

- Why America is a "flawed democracy"

- Hong Kongers are bracing for an even wider clampdown on dissent

- What could kill the $1trn artificial-intelligence boom?

- Nigeria's high-cost oil industry is in decline

- Fortnum & Mason caters to a demand for festive fun

- How American bankers dodged the MAGA carnage

- USAID Workforce Slashed From 10,000 to Under 300 as Elon Musk's DOGE Decimates Agency

- The Lebanese-American businessman in Donald Trump's inner circle

- What North Korea gains by sending troops to fight for Russia

- Donald Trump revives ideas of a Star Wars-like missile shield

- John Conway died on April 11th

- Joe Biden leaked Israel's first plan to end the war in Gaza

- The French government's survival is now in Socialist hands

- Economic data, commodities and markets

- The weekly cartoon

- How Ukraine uses cheap AI-guided drones to deadly effect against Russia

- A toast to the possible end of Chinese tariffs on Australian wine

- How FIFA was outplayed by Electronic Arts

- India's YouTubers take on Narendra Modi

- The United States says corruption in Paraguay starts at the top

- Time could be running out for TikTok

- Economic data, markets and commodities

- Britain's unusual stance on Chinese electric vehicles

- Politics

- Mark Robinson has hijacked his own campaign in North Carolina

- America's internet giants are being outplayed in the global south

- Checks and Balance newsletter: gender politics in the election

- A chunk of asteroid is coming to Earth

- Frank Auerbach aimed only at one memorable image

- DeepSeek: Everything you need to know about the AI chatbot app

- What a School Performance Shows Us About Japanese Education

- India must make much deeper changes if it is to sustain its growth

- As stock prices fall, investors prepare for an autumn chill

- NHS dentistry is decaying

- America is in the midst of an extraordinary startup boom

- Germany's economy goes from bad to worse

- Indonesia's Prabowo is desperate to impress Trump and Xi

- Wagner routinely targets civilians in Africa

- Why Australia is not yet a critical minerals powerhouse

- This week's covers

- Fury erupts in China over a food-safety scandal

- Finding a driving test in Britain is painful, slow and expensive

- Donors are already mulling a Marshall Plan for Ukraine

- Business

- Is Sir Keir Starmer a chump?

- Cristina Calderón was the only full-blooded member of her people

- An advocate of sustainable capitalism explains how it's done

- America's recession signals are flashing red. Don't believe them

- Economic data, commodities and markets

- Economic data, commodities and markets

- "Don't Look Up", Adam McKay's political farce, is bleakly realistic

- The Young Thug trial could be Fani Willis's last big act

- KAL's cartoon

- How the war split the mafia

- Economic data, commodities and markets

- South-East Asia's stodgy conglomerates are holding it back

- America's marijuana industry is wilting

- Ousmane Dembélé is finally emerging as the star after years as a football piñata | Barney Ronay

- Indian tourists are conquering the world

- Why GM crops aren't feeding Africa

- Ukraine's desperate struggle to defend Kharkiv

- Who will defend Europe?

- Emmanuel Macron loses another prime minister

- Ecuador's president dissolves Congress to avoid impeachment

- KAL's cartoon

- Business

- Letting more migrants in by stealth

- After a year of war, Sudan is a failing state

- Yang Huaiding died on June 13th

- Economic data, commodities and markets

- A scientific discovery could lead to leak-free period products

- The revolt against Binyamin Netanyahu

- Israel's ultra-Orthodox still won't fight, invoking scripture

- Ron Galella, the original paparazzo, died on April 30th, aged 91

- America and China are talking. But much gets lost in translation

- The limits of Turkey's strategic autonomy

- Blighty newsletter: How Canada's Conservatives are shaping the Tories

- An assassination attempt against Slovakia's prime minister, Robert Fico

- Economic data, commodities and markets

- 'No one will question it': Trump says US will 'take' Gaza not buy it – video

- Pelé, king of the beautiful game

- A new breed of protest has left Kenya's president tottering

- Suffering from the Bhopal disaster in India continues, 40 years on

- Don't like your job? Quit for a rival firm

- In preparing for disasters, museums face tough choices

- A big transgender-rights case heads to America's Supreme Court

- El Salvador's authoritarian president is becoming a regional role model

- Japanese businesses are trapped between America and China

- Javier Milei's liberal reforms are hurting yerba mate growers

- 65 Best Podcasts (2025): True Crime, Culture, Science, Fiction

- Wallowing in a soup of despair? Try 'lemonading' to buck the gloom

- Turkey is still just a democracy, but it is not certain to remain that way

- Business

- The global tourism boom is shifting to Asia

- Hong Kong smothers dissent ahead of the Tiananmen anniversary

- How Vladimir Putin created a housing bubble

- A stealth attack came close to compromising the world's computers

- Software is now as important as hardware in cars

- Why Louis Vuitton is struggling but Hermès is not

- UFOs are going mainstream

- Are bosses right to insist that workers return to the office?

- Trump's trillion-dollar tax cuts are spiralling out of control

- Step inside The Economist's summer issue

- What separates Tony Blair's Labour from the party today?

- Africa is juggling rival powers like no other continent

- The deficiencies of the Latin American state loom large

- Why is Xi Jinping building secret commodity stockpiles?

- Why investors' "Trump trade" might be flawed

- Should you buy expensive stocks?

- The American economy has left other rich countries in the dust

- Economic data, commodities and markets

- Buffett's Berkshire Hathaway slashes stakes in Bank of America and Citi

- Donald Trump's potential SCOTUS picks

- Bill Gates Traumatized His Parents—and Other Stories of a Wild, Wonky Youth

- Obituary: Robert Morgenthau died on July 21st

- Thomas Neff's idea rid the world of a third of its nuclear warheads

- Turkey sits at the crossroads of tectonic plates as well as civilisations

- Technology is deepening civilian involvement in war

- The 7 Best Scented Candles (2025)

- The world's religions face a post-pandemic reckoning

- OpenAI says its board of directors 'unanimously' rejects Elon Musk's bid

- Andrés Manuel López Obrador will haunt his successor

- The Big Mac index: where to buy a cheap hamburger

- Iran and Israel's shadow war explodes into the open

- Female soldiers are changing how armed forces work

- Brazil, India and Mexico are taking on China's exports

- How scared is China of Donald Trump's return?

- Business

- Indonesia's new capital is built on vanity

- Blighty newsletter: Can Labour fix the British state?

- Latin American cities are becoming far nicer for poorer inhabitants

- Western values are steadily diverging from the rest of the world's

- Why global bond markets are convulsing

- Tensions with the West are fuelling China's anxiety about food supplies

- Who is supplying Russia's arms industry?

- Farmer fight: Jeremy Clarkson versus Roald Dahl

- Sources and acknowledgments

- "The Traitors", a reality TV show, offers a useful economics lesson

- Three charts show that America's imports are booming

- It's a bird, it's a plane…it's a Chinese flying car

- How India's imports of Russian oil have lubricated global markets

- Economic data, commodities and markets

- Why have markets grown more captivated by data releases?

- The bunkers on Beirut's golf course are in the crosshairs

- How Poland emerged as a leading defence power

- The OnePlus Open 2 isn't happening this year

- Sources and acknowledgments

- What is Britain's Labour government for?

- "Trading Places" and the challenge of troubling art of the past

- Economic data, commodities and markets

- Traute Lafrenz showed that resistance to the Nazis was possible

- Economic data, commodities and markets

- Taiwanese politics faces a crucial election in early 2024

- Edward de Bono died on June 9th

- Comrade Duch died on September 2nd

- Naval drills in the Indian Ocean give bite to the anti-China "Quad"

- How digital gaming spreads far and wide

- Obituary: Li Peng died on July 22nd

- Obituary: Shuping Wang died on September 21st

- This week's covers

- America's rural-urban divide nurtures wannabe state-splitters

- Recent heatwaves are a harbinger of Africa's future

- What would a rout do to the Tories?

- Why People Act So Weirdly at Airports

- How China uses Russia to chew up the UN

- The world this year 2023

- The family feud that holds the Philippines back

- What do Syria's other rebels want now?

- Tech, Media & Telecom Roundup: Market Talk

- Why don't more countries import their electricity?

- Big oil may be softening its stance on climate-change regulation

- The urgent need to reform political systems

- Supporters of Jair Bolsonaro mount an insurrection in Brazil

- How America learned to love tariffs

- Obituary: Frenchy Cannoli, who treated hashish like fine wine

- Trump for Dummies

- The Omicron variant advances at an incredible rate

- A flexible patch could help people with voice disorders talk

- To Find Life on Mars, Make Microbes Wiggle

- Cuba's Communist government taps the diaspora for cash

- America's jobs report is not as strong as it seems

- Britain's budget is heavy on spending but light on reform

- Colm Toibin's new novel brings Thomas Mann to life

- Vital election races in Wisconsin are awfully close

- Stocks Sink in Broad AI Rout Sparked by China's DeepSeek

- Economic data, commodities and markets

- Politics

- Demand for high-end cameras is soaring

- Checks and Balance newsletter: Joe Biden's farewell shot at the oligarchy

- The risk of election violence in America is real

- Which countries have the best, and worst, living standards?

- The G7 sketches a development-finance initiative to counter China's

- What betting markets got right and wrong about Trump's victory

- Economic data, commodities and markets

- Will Spain's prime minister suddenly quit?

- Economic data, commodities and markets

- Economic data, commodities and markets

- Business

- How 1.4bn Indians are adapting to climate change

- The war in Ukraine shows how technology is changing the battlefield

- Sources and acknowledgments

- The builder of the Titanic is struggling to stay afloat

- How Murderbot Saved Martha Wells' Life

- Ethiopia is in the midst of a kidnapping epidemic

- Why so many Chinese graduates cannot find work

- In China's "median city" people are surprisingly risk-averse

- The high cost of schools closed by covid

- How to provoke the fury of Xi Jinping

- UK general election: live results and analysis

- Julian Assange's plea deal: a suitable end to a grubby saga

- Britain's last imperialists

- Meta Is Looking to Get Into the AI Humanoid Robot Business

- Britain's vote on assisted dying is just the beginning

- Jeremy Corbyn wants more nice things, fewer nasty ones

- A trove of photographs casts light on Bangladesh's liberation war

- China's youth are rebelling against long hours

- Sudan: the war the world forgot

- America's far right is increasingly protesting against LGBT people

- Meta's next big bet may be humanoid robotics

- Will a new "pact" of ten laws help Europe ease its migrant woes?

- Are American rents rigged by algorithms?

- Why Indonesia's horror films are booming

- China is exerting greater power across Asia—and beyond

- The Hollywood Foreign Press Association does penance for its sins

- China and the EU risk a trade war

- Loons and the Tory leadership battle in Britain

- How China and Russia could hobble the internet

- Elon Musk's 'Fork in the Road' Is Really a Dead End

- An Adviser to Elon Musk's xAI Has a Way to Make AI More Like Donald Trump

- India's consumers are changing how they buy

- Layoffs accelerate at federal agencies with more cuts to come

- The states that will decide America's next president

- The children of Iran's revolution still want to go West

- Highlights of a year when art mattered as much as ever

- A dangerous dispute in the Horn of Africa

- Germany's Social Democrats narrowly escape disaster in Brandenburg

- Angela who? Merkel's legacy looks increasingly terrible

- Tanzania's opposition, once flat on its back, is now on its knees

- The new front line of British politics is just lovely

- How will Britain vote on July 4th?

- Meet the most ruthless CEO in the trillion-dollar tech club

- North Korea's aid to Russia raises difficult questions in China

- The ICJ orders restraint from Israel in Rafah

- What would Robert F. Kennedy junior mean for American health?

- This week's covers

- Iran's new leaders stand at a nuclear precipice

- American restrictions on hitting Russia are hurting Ukraine

- Could China, Russia's "no-limits" friend, help rebuild Ukraine?

- AI and security startups blossom on cloudy days

- The return of a mask stolen by Belgium is stoking violence in Congo

- Ahmed al-Sharaa declares himself president of Syria

- Economic data, commodities and markets

- Erotic statues in Peru are challenging taboos

- South Africa's future is in the hands of a divided ANC

- Locust-busting is getting an upgrade

- Array Collective, a group from Belfast, wins the Turner prize

- Economic data, commodities and markets

- Bernard Haitink believed that genius should speak for itself

- Gary Gensler is the most controversial man in American finance

- The horrors of the reply-all email thread

- RFK junior and Tulsi Gabbard, set to sail through a cowed Senate

- How much oil can Trump pump?

- Look for 'Slow Flower' Bouquets, Plants Grown without Health-Harming Chemicals Used in Overseas Operations

- Obituary: Harold Bloom died on October 14th

- Where British MPs should look before the vote on assisted dying

- India throws another opposition leader in jail as elections loom

- Donald Trump once tried to ban TikTok. Now can he save it?

- Why China's confidence crisis goes unfixed

- More borrowers turn to private markets for credit

- Economic data, commodities and markets

- Emmanuel Macron faces heavy losses after a short campaign

- KAL's cartoon

- China wants to export education, too

- Hong Kong passes a security law that its masters scarcely need

- Today's NYT Mini Crossword Answers for Saturday, Feb. 15

- How much trouble is Boeing in?

- One of the biggest energy IPOs in a decade could be around the corner

- A variety of new batteries are coming to power EVs

- The tricky politics of choosing Oxford's next chancellor

- Reassessing Obama's biggest mistake

- A Nose-Computer Interface Could Turn Dogs Into Super Detectors

- Economic data, commodities and markets

- South-East Asian Muslims are incensed by the war in Gaza

- Putin's plan to dethrone the dollar

- UK Secret Order Demands That Apple Give Access to Users' Encrypted Data

- Politics

- What ChatGPT's corporate victims have in common

- Economic data, commodities and markets

- Poland's stockmarket has a hot new entrant

- Can big food adapt to healthier diets?

- English kids are back in school. What about the teachers?

- After 50 years, the Residents are still on the road

- Indians are going gooey over dogs

- Business

- The "Venice of Africa" is sinking into the sea

- Court filings show Meta paused efforts to license books for AI training

- Norway's weak currency presents a mystery

- This week's covers

- Secator - The Pentester'S Swiss Knife

- Imran Khan comes under further pressure in Pakistan

- China's slowing economy, seen from ground level

- The Economist's agony uncle returns

- Economic data, commodities and markets

- Turkey has given up promoting political Islam abroad

- Meet Argentina's richest man

- A much-praised British scheme to help disabled workers is failing them

- This week's covers

- Imperial borders still shape politics in Poland

- Why America and Europe fret about China turning inwards

- Pope Benedict XVI was an iron fist in a white glove

- 'Bloody fingers with pink nails': how Sasha DiGiulian broke climbing's glass ceiling

- Abuse by priests in Italy can no longer be tolerated by the Vatican

- A cautionary tale from the streets of San Francisco

- Biden outdoes Trump with ultra-high China tariffs

- Talk of war between Israel and Lebanon is growing

- Turkey's President Erdogan faces a new challenge from Islamists

- Don't propose with a diamond

- KAL's cartoon

- Why robots should take more inspiration from plants

- Rumours of the trade deal's death are greatly exaggerated

- AI Alexa and AI Siri face bugs and delays

- A short history of Hollywood's poison-pen letters to itself

- This week's cover

- How, if at all, might Russia be punished for its war crimes in Ukraine?

- Investors are increasingly optimistic about Brazil's economy

- Is artificial intelligence making big tech too big?

- F.W. de Klerk had to abandon what his ancestors had believed in

- Africa's tiger economy is shot

- European airlines are on a shopping spree

- Benny Gantz and Gadi Eisenkot leave Israel's war cabinet

- Abir Mukherjee adds a twist to his winning crime formula

- Young people are having less fun

- Helen Fisher found out the science behind romance

- A battle royal over deep-sea archaeology in the Caribbean

- Turkey's long hard struggle with inflation

- Venezuela's opposition is getting smashed

- The US tax code will change next year; the presidential election will determine how

- Talks at the WTO to save the world's fish fail to reach agreement

- KAL's cartoon

- How many Russian soldiers have been killed in Ukraine?

- Streaming services are helping Arab producers liven up television

- Desmond Tutu believed that truth was the best weapon

- Politics

- The first week after prison is the deadliest for ex-inmates

- How Bob Dylan broke free

- Meet Javier Milei, the front-runner to be Argentina's next president

- Economic data, commodities and markets

- Business

- Why food is piling up on the edge of Gaza

- KAL's cartoon

- Most children in poor countries are being failed by their schools

- Ukraine fears being cut out of talks between America and Russia

- Rosemary Smith set out to prove that women drivers could do as well as men

- American and Chinese scientists are decoupling, too

- Best Internet Providers in Cheektowaga, New York

- Business

- Antony Sher pushed the boundaries of Shakespeare's plays

- Are Canadian cities better than America's?

- Kamala Harris's closing argument

- Banks, at least, are making money from a turbulent world

- Politics

- Japan's ruling party is in crisis

- Should you have to prove your age before watching porn?

- Why big oil is wading into lithium

- Temu and Shein Raised Prices, Removed Products as Trump's China Tariffs Went Into Effect

- Sources and acknowledgments

- American long-range missiles are coming back to Europe

- Politics

- Obituary: Judith Krantz died on June 22nd

- China is using archaeology as a weapon

- Vancouver pioneered liberal drug policies. Fentanyl destroyed them

- The state of democracy in Africa and the Middle East

- Checks and Balance newsletter: Why can't politicians just admit when they're wrong?

- The Great Barrier Reef is seeing unprecedented coral bleaching

- The curse of the Michelin star

- Elon Musk's xAI goes after OpenAI

- A new "quartet of chaos" threatens America

- How many Russian soldiers have died in Ukraine?

- What a takeover offer for 7-Eleven says about business in Japan

- Why fine wine and fancy art have slumped this year

- Investors beware: summer madness is here

- How shallow was Labour's victory in the British election?

- Economic data, commodities and markets

- Is inflation morally wrong?

- Generation K: Keir Starmer's cohort of Labour candidates

- Canada has finally decided where to store its nuclear waste

- War in space is no longer science fiction

- Venezuela's autocrat, Nicolás Maduro, threatens to annex Guyana

- Will El Mayo's arrest slow the spread of fentanyl?

- Remembering the Normandy landings

- The DOGE Squad Is Squandering a Once-in-a-Lifetime Opportunity

- China meets its official growth target. Not everyone is convinced

- The woman who will lead Chile's counter-revolution

- Could the Kamala Harris boost put Florida in play for Democrats?

- Carbon-dioxide-removal options are multiplying

- Hfinger - Fingerprinting HTTP Requests

- Taiwan braces for America's election

- Europe today is a case of lots of presidents yet nobody leading

- Will the trouble ever end for Volkswagen and its rivals?

- Hail China's new "ice-and-snow economy"

- Latin America remains a playground for Russian intelligence

- What makes Australia so liveable?

- Accounting for flood risk would lower American house prices by $187bn

- Britain's party manifestos lack detail but leave clues

- The ubiquitous J.B. Pritzker, the man behind the Democrats' party

- In Congo, a desperate struggle to control the deadly mpox outbreak

- Our Big Mac index shows how burger prices differ across borders

- How the Philippines is turning the water-cannon on China

- The relationship between Israel and Turkey is at breaking point

- America boosts Israel's missile shield. What did it get in return?

- Sinéad O'Connor hated the very idea of being a pop star

- The extreme right after the riots in Britain

- Diego Maradona offers central bankers enduring lessons

- A Justice Dept. in Turmoil Moves to Dismiss Eric Adams's Corruption Case

- This week's cover

- Checks and Balance newsletter: Trump is embracing a shift in Republican priorities

- Kamala Harris lacks charisma and time

- How plundered Gaulish silver ended up in Roman coins

- Business

- Kamalamania and the drive for abortion rights are a potent mix

- Economic data, markets and commodities

- The pandemic will spur the worldwide growth of private tutoring

- Offshore worker Robbie Robson was bludgeoned to death on an oil rig. Was it a random attack or does the industry have questions to answer?

- The world this year 2024

- Covid-19 has shone a light on racial disparities in health

- Latin America's farmers are cashing in on hot hot-cocoa prices

- A Nigerian's guide to weddings during the cozzie livs

- Israel's hardliners reckon Gaza's chaos shows they must control it

- Lebanon faces its worst crisis since the end of the civil war

- The world needs a more active Germany

- Calling Donald Trump a threat to the rule of law has backfired

- Best Internet Providers in Carlsbad, California

- The Sierra Nevada Just Had an 'Epic Snow Day'

- Meet the outspoken maverick who could lead India

- China is tightening its grip on the world's minerals

- Could seaweed replace plastic packaging?

- The rise of user-created video games

- Will Mark Zuckerberg's Trump gamble pay off?

- Business

- Trump Team Looks to Drastically Cut NOAA Staff and Budget

- It's not just Paris. Bedbugs are resurgent everywhere

- For Western democracies, the price of avoiding a clash with China is rising

- Jean-Jacques Savin wanted to defy old age

- Japan's strength produces a weak yen

- Wanted: a Britain economics writer

- Trump warns 'all hell is going to break out' if Gaza hostage deadline not met by Hamas – video

- Get in, Loser—We're Chasing a Waymo Into the Future

- How China's public views Taiwan's elections

- Why east Germany is such fertile ground for extremists

- America is not ready for a major war, says a bipartisan commission

- Brazil and Colombia are curbing destruction of Amazon rainforest

- Don't be fooled by America's "new" supply chains

- Japanese men have an identity crisis

- 'I don't know whether it's sustainable': climate crisis and TikTok change face of mountain rescue work in Lake District

- The world's most unlikely safe haven

- The curse of being too competent

- What to make of China's massive cyber-espionage campaign

- Oil traders are flocking to sanctions-free Venezuela

- Sttr - Cross-Platform, Cli App To Perform Various Operations On String

- Floods in Spain cause death and devastation

- Vladimir Putin is dragging the world back to a bloodier time

- China approves the world's most expensive infrastructure project

- AI models make stuff up. How can hallucinations be controlled?

- Maggie Smith, the dowager countess of comic timing

- Social-media platforms are destroying evidence of war crimes

- Are manufacturing jobs really that good?

- Germany's Economic Model Is Broken, and No One Has a Plan B

- The number of American students in China is going up again

- Economic data, commodities and markets

- Anonymous tipsters, angry at Russia, help detect sanctions-busters

- BokuLoader - A Proof-Of-Concept Cobalt Strike Reflective Loader Which Aims To Recreate, Integrate, And Enhance Cobalt Strike's Evasion Features!

- Yahya Sinwar will hold sway over Hamas from beyond the grave

- The deal that freed Evan Gershkovich was more than a prisoner swap

- Brazil's foreign policy is hyperactive, ambitious and naive

- Business

- Syria's new rulers say they are keen to integrate foreign fighters

- Disney will cut 7,000 jobs as it restructures its business

- A remarkable new era begins in South Africa

- Paris could change how cities host the Olympics for good

- Uruguay is losing its reputation as Latin America's success story

- Peng Ming-min fought for the idea of "one China and one Formosa"

- What drives people to vote the way they do?

- Violent jihadists are getting frustrated by the new Syria

- Congo's M23 rebellion risks sparking a regional war

- Elon Musk threatens to widen the rift between Europe and America

- Economic and financial indicators

- Economic data, commodities and markets

- Is the revival of Paris in peril?

- Economists need new indicators of economic misery

- The future of the Chinese consumer—in three glasses

- Where are Europe's most expensive cities for renters?

- Is Uruguay too stable for its own good?

- 'Dengue Boy' Is the Weird, Fleshy Novel You Need Right Now

- Are You Lonely? Adopt a New Family on Facebook Today

- NativeDump - Dump Lsass Using Only Native APIs By Hand-Crafting Minidump Files (Without MinidumpWriteDump!)

- KAL's cartoon

- Short of cash, Brazil's government may end its gambling prohibition

- NASA is selling a brand-new Moon rover

- Why avocados are driving another sort of green economy in Kenya

- The Heart Emoji Is Meaningless

- New yeast strains can produce untapped flavours of lager

- Judges Generally Let Prosecutors Drop Charges. Maybe Not for Adams.

- Donald Trump's terrifying closing message

- An apparent coup in Bolivia founders, but the country remains in trouble

- Europe has no escape from stagnation

- Sources and acknowledgments

- Live results of the US presidential election

- Simone Biles is the most decorated gymnast in history

- Calls to boycott the Beijing winter Olympics are growing stronger

- What identity politics will Kamala Harris practise?

- KAL's cartoon

- As wellness trends take off, iodine deficiency makes a quiet comeback

- Britain's Conservative Party faces up to its own mortality

- Sport is getting hotter, harder and deadlier

- British Paralympian is first person with physical disability cleared for space mission

- Does Britain need a National Wealth Fund?

- The best podcasts of 2021

- Will Israel retaliate against Iran, or hold back?

- Financial Services Roundup: Market Talk

- Tilda Swinton decries 'internationally enabled mass murder' at Berlin film festival

- Would you really die for your country?

- Mexico's gangs could be the country's fifth-biggest employer

- A fresh Russian push will test Ukraine severely, says a senior general

- How gaga is MAHA?

- The bungee-jumping, sandal-clad right-wingers of British politics

- Kung fu gives Africans their kicks

- A country that is on the front line

- Can the good ship Europe weather the Trumpnado?

- This week's cover

- China doesn't want people flaunting their wealth

- The alarming foreign policies of France's hard right and hard left

- Small climate projects cannot take the place of all large ones

- The last scraps of the Haitian state are evaporating

- Silvergate is the latest victim of the crypto meltdown

- Economic data, commodities and markets

- Can China smash the Airbus-Boeing duopoly?

- America is less dominant in defence spending than you might think

- Inside the world of crazy rich Indians

- Richard Simpson strove to balance buyers against manufacturers

- The pandemic is boosting efforts to get the old out of prison

- A search for roots is behind a surge in Scottish tourism

- J.D. Vance, an honorary Frenchman, sends Europe into panic mode

- Why China is building a Starlink system of its own

- How to manage politics in the workplace

- The Scientific Literature Can't Save You Now

- Economic data, commodities and markets

- Inside the shared studio of Thom Yorke and Stanley Donwood

- Economic data, commodities and markets

- Economic data, commodities and markets

- America's best-known practitioner of youth gender medicine is being sued

- Joss Naylor never let any mountain defeat him

- Missionary creep

- Physics reveals the best design for a badminton arena

- How the wolf went from folktale villain to culture-war scapegoat

- A region caught between stagnation and angry street protests

- A net-zero world needs new markets and institutions

- GiveDirectly does what it says on the tin

- South American vineyards brace for tricky summers ahead

- This week's covers

- Economic data, commodities and markets

- William Dement died on June 17th

- At last, Wall Street has something to cheer

- Sammy Basso led research into his own rare disease

- Why Donald Trump's protectionist zeal has only grown

- Aland is lovely, weapon-free and too close to Russia

- Senegal proves the doomsayers wrong

- How Russia is trying to win over the global south

- T.S. Shanbhag died of coronavirus on May 4th

- Israel and Hamas are not that far from a ceasefire agreement

- Russia continues to advance in eastern Ukraine

- Britons should brace for more travel chaos

- The next terrifying war: Israel v Hizbullah

- As Syria's new leaders settle in, life in the capital resumes

- How to harvest moisture from the atmosphere

- Progress on the science of menstruation—at last

- Thich Nhat Hanh believed that Buddhism should be a force for change

- Why Central Americans migrate to the United States when they do

- How to train your large language model

- Trump administration adds note rejecting 'gender ideology' to government websites

- The former president of Honduras is tried for drug trafficking

- Even Xi Jinping is struggling to fix regional inequality

- Is China a climate saint or villain?

- The economics of American lotteries

- Checks and Balance newsletter: The enduring game of political ads in America

- The world needs codes quantum computers can't break

- The 33 Best Shows on Apple TV+ Right Now (February 2025)

- Sam Nujoma obituary

- 10 Years After 'Stucky,' "Captain America: Brave New World" Signals a Big Shift in Marvel Fandom

- Blighty newsletter: Will Britain's Trump trauma repeat itself?

- Ancient, damaged Roman scrolls have been deciphered using AI

- Video: How we studied the lessons of Ukraine

- Why southern Europeans will soon be the longest-lived people in the world

- Why is Italy's public-debt burden so big?

- What Trump's new antitrust enforcers mean for business

- The war in Ukraine has rattled both sides of Cyprus

- 'There's no stress': gamers go offline in retro console revival

- Donald Trump wants a weaker dollar. What are his options?

- We're hiring a Science and Technology Correspondent

- Patriotism is replacing purpose in American business

- The job of Iran's president is a study in humiliation

- Britain's new government may cut the number of Channel crossings

- Business

- Does Donald Trump have unlimited authority to impose tariffs?

- Yurii Kerpatenko refused to bow to Russian orders

- When brawn and technology ruin the spectacle of sports

- 2025: The Year of the AI App

- Most Americans think moderate drinking is fine

- Georgia's ruling party crushes the country's European dream

- Private firms are driving a revolution in solar power in Africa

- Economic data, commodities and markets

- The war for AI talent is heating up

- The Untold Story of a Crypto Crimefighter's Descent Into Nigerian Prison

- The surprising stagnation of Asia's middle classes

- China is the West's corporate R&D lab. Can it remain so?

- The self-help book began in the land of the stiff upper lip

- Europe is bidding a steady farewell to passport-free travel

- Weak commitments from the G20 cast a shadow over COP26's opening

- An economic calm before the storm?

- The Mexican Supreme Court does battle with AMLO

- Rolls-Royce cars push the pedal on customisation

- Inflation is down and a recession is unlikely. What went right?

- Working-class parents are becoming more like middle-class ones

- This week's covers

- Dealers are selling war trophies to buy weapons for Ukraine

- A protest against America's TikTok ban is mired in contradiction

- Hamas Releases Four Female Israeli Soldiers Under Gaza Cease-Fire Deal

- The trial of Lucy Letby has shocked British statisticians

- The weekly cartoon

- The WIRED Guide to Aliens

- Are Dating Apps Getting Worse?

- We're hiring a global correspondent

- Carl Bernstein's memoir traces his path to Watergate

- Narendra Modi needs to win over low-income Indians

- America braces for Taiwan's election—and vice versa

- Southern Italy needs private enterprise and infrastructure

- A new type of jet engine could revive supersonic air travel

- Economic data, commodities and markets

- Britain's Labour Party has forgotten how to be nice

- Indonesia election tracker: Prabowo Subianto wins the presidency

- Messaging services are providing a more private internet

- India is souping up its nuclear missiles

- Can Home Depot's "amazing era" return?

- Chinese EV-makers are leaving Western rivals in the dust

- How far could America's stockmarket fall?

- Cryptocurrencies are spawning a new generation of private eyes

- The Trump shooting has made a mockery of the Secret Service

- Singapore's foreign admirers see only the stuff they like

- Economic data, commodities and markets

- The weekly cartoon

- AI can catalogue a forest's inhabitants simply by listening

- A Chinese opera star's ode to Russia—from a Ukrainian bomb site

- Sources and acknowledgments

- What Will It Take for Home Buyers to Start Asking for a Disaster Discount?

- Donald Trump claims victory

- Can the rich world escape its baby crisis?

- Election lawsuits are flooding America's courts

- The Wild True Story Behind Kendrick Lamar's Super Bowl Halftime Show

- Death and destruction in a Russian city

- Politics

- This week's cover

- A landslip in Hong Kong fuels resentment of the rich

- Inflation usually hits America's poor hardest. Not this time

- Mexico's government is suing American gun manufacturers

- A Night at the Kennedy Center, Just After Trump's Takeover

- A new archive preserves the creative legacy of the East Village

- Blighty newsletter: Britain's advantage in the AI race

- Joe Biden, master oil trader

- Russian exiles are making a mark in the Caucasus and Central Asia

- Economic data, commodities and markets

- Getting into the vanguard of the Chinese elite

- Machines might not take your job. But they could make it worse

- How to end the nightmare of Asia's choked roads

- A Texas judge gives a nod to America's at-home distillers

- The path ahead for China's Belt and Road Initiative

- Xi Jinping plays social engineer

- Economic data, commodities and markets

- China and Russia have chilling plans for the Arctic

- Can Colombia's mercurial president bring "total peace"?

- A TV dramatisation of Mussolini's life inflames Italy

- Brother Andrew secretly carried Bibles behind the Iron Curtain

- Is India's education system the root of its problems?

- Coffee Boosts Beneficial Gut Bacterium

- Tim Dowling: I'm back at the shop where I think I once saw a ghost

- Taiwan desperately needs support from the world

- Nukes and King Charles—but no door key

- Why migration is in such a mess once more

- In Crimea, Ukraine is beating Russia

- Manmohan Singh was India's economic freedom fighter

- Labour is on course for a huge victory in the British election

- JD Vance stuns Munich conference with blistering attack on Europe's leaders

- A peace conference over Ukraine is unlikely to silence the guns

- The urge to protect

- The death of Iran's president will spark a high-stakes power struggle

- Vivian Silver knew no good could ever come of war

- Economic data, commodities and markets

- Lata Mangeshkar was the soundtrack of newly independent India

- When party propaganda falls flat

- A year of war in Ukraine, in maps

- Health-care reform is upending the lives of China's doctors

- Germany's "business model is gone", warns Friedrich Merz

- What the Paris agreement of 2015 meant

- Casinos are booming in South-East Asia

- KAL's cartoon

- Australians are no longer united on Aboriginal rights

- By raising the retirement age, has China created a care crisis?

- Our favorite budget Roomba drops to a new record-low price in Amazon Presidents' Day sale

- The Germany-shaped void at Europe's heart

- BookTok has passion—and enormous marketing power

- This week's covers

- Is there a genetic link between endometriosis and the brain?

- Why people have fallen out of love with dating apps

- European firms are smaller and less profitable than American ones

- Reddit CEO Says Paywalls Are Coming Soon

- Do You Really Have a Spoonful of Microplastics in Your Brain?

- Tech bros love J.D. Vance. Many CEOs are scared stiff

- Hilary Mantel saw things that others couldn't

- A nationalist effort to rebrand the Chinese dragon

- Turkey and Central Asia are riding together again

- A price war breaks out among China's AI-model builders

- Some forms of chronic pain are particularly mysterious

- Sean Connery died on October 31st

- The AirFish is a fast ferry that will fly above the waves

- Has social media broken the stockmarket?

- Chuck Yeager died on December 7th

- Fifteen notable lives lost in 2022

- A Hacker Group Within Russia's Notorious Sandworm Unit Is Breaching Western Networks

- Bowel cancer is rising among young people

- How crises reshaped the world financial system

- Can Indonesia make its Top Gun dreams a reality?

- Le Pen's hard right looks set to crush Macron's centrists

- KAL's cartoon

- Ann Shulgin pioneered the use of psychedelics in therapy

- Bluesky gets growth and analytics tools with BlueSkyHunter launch

- The best albums of 2021

- Trump Says He Wants to Get Rid of Nukes. He Spent His First Presidency Making That Impossible

- How many people have died in Gaza?

- Are India's corruption police targeting Narendra Modi's critics?

- First Outbreak of Highly Pathogenic H5N9 Reported in U.S. Ducks

- The drug-overdose capitals of Europe

- Vast government debts are riskier than they appear

- Will chatbots eat India's IT industry?

- Australia joins the industrial arms race

- Climate change casts a shadow over Britain's biggest food export

- China's satellites are improving rapidly. Its army will benefit

- Rwanda's reckless plan to redraw the map of Africa

- Shirley Conran wrote a bonkbuster to teach schoolgirls about sex

- Why are Remainers so weak in post-Brexit Britain?

- How the Democrats wandered away from America's workers

- Politics

- Xi Jinping is obsessed with political loyalty in the PLA

- The world's richest countries in 2024

- What the world wants from Joe Biden

- Politics

- Antony Blinken swoops into a violent hotspot close to home

- A pair of Indian and Russian probes approach the Moon

- How not to work on a plane

- What the remaking of Labour reveals about Sir Keir Starmer

- Scotland's failure to build homes is mainly due to its government

- Iran's supreme leader is terrified of people power

- What a Serbian cave tells you about the weather 2,500 years ago

- Economic data, commodities and markets

- As Syria's regime collapses, Erdogan eyes victory over the Kurds

- Adolfo Kaminsky saved thousands of Jews by changing their identities

- Fighting disinformation gets harder, just when it matters most

- Inside Fashion's Mysterious St. Catherine's Day Celebrations

- Economic data, commodities and markets

- Foreign Hackers Are Using Google's Gemini in Attacks on the US

- Economic data, commodities and markets

- The green revolution will stall without Latin America's lithium

- Colombia prepares for a vanilla boom

- Can an agreement with the EU resurrect Mercosur?

- Despite flaws, South Africa's democracy is stronger than its neighbours'

- MAGA types have a point on debanking

- Britain's railways go from one extreme to another

- The Pentagon is hurrying to find new explosives

- Why Latin America is the world's trade pipsqueak

- Economic data, commodities and markets

- How the mad, bad Maduro regime clings to power

- Elinor Otto did not realise what giant strides she was making for women

- Director of the Game 'Avowed' Says AI Can't Replace Human Creativity

- Places claiming to be centenarian hotspots may just have bad data

- Vast amounts of the world's shipping sails unseen

- Five reasons why Indonesia's election matters

- Microbiome treatments are taking off

- Kamala Harris moves ahead—just—in our final election forecast

- India's economic policy will not make it rich

- Richard Leakey established Kenya as a prime source of hominid fossils

- Who is up and who is down on China's economic team

- KAL's cartoon

- A Google AI has discovered 2.2m materials unknown to science

- Meet Gabriel Attal, France's young prime minister

- Why Chinese banks are now vanishing

- Labour's landslide victory will turn politics on its head

- China wants to change, or break, a world order set by others

- The poisonous global politics of water

- A sophisticated civilisation once flourished in the Amazon basin

- Hsiao Bi-khim is Taiwan's cat warrior

- Antidepressant use is surging in Britain

- The US Army's chief of staff has ideas on the force of the future

- The economics of the climate

- Economic data, commodities and markets

- Ukraine's defenders anxiously dig in for a looming Russian assault

- India bridles at China's growing presence in South Asia

- AMLO is trying to bury the tragedy of Mexico's missing people

- Judge Lets Musk's Team Keep Access to Records at Some Agencies, for Now

- Ranajit Guha revolutionised the study of India's past

- Can Israel's economy survive an all-out war with Hizbullah?

- BYOSI - Evade EDR's The Simple Way, By Not Touching Any Of The API's They Hook

- Scientists want to tackle multiple sclerosis by treating the kissing virus

- Obituary: Toni Morrison died on August 5th

- New Bird Flu Strain in Cows and Cat Infections Raise Concern for Human Exposure

- Some federal workers given just 30 minutes to leave amid Trump layoffs

- London is ageing twice as quickly as the rest of England

- Donald Tusk mulls which of the previous government's plans to axe

- Obituary: Sutopo Purwo Nugroho died on July 7th

- To end birthright citizenship, Trump misreads the constitution

- Elon Musk's Toxicity Could Spell Disaster for Tesla

- Agitu Gudeta was killed on December 29th

- What would get China's consumers spending?

- 2024 is a giant test of nerves for democracy

- Economically, covid-19 has hit hard-up urbanites hardest

- The danger of excessive distraction

- US election forecast: who will control the House of Representatives?

- America returns to containment to deal with Russia and China

- France's new coalition yanks the country a step to the right

- Labour's budget has given the bond market indigestion

- Farewell, Don Draper: AI is coming for advertising

- Ashok - A OSINT Recon Tool, A.K.A Swiss Army Knife

- Vast satellite constellations are alarming astronomers

- A 'gorgeous medieval' town in Tuscany and other readers' tips across Italy

- How China sees Gaza

- How pop culture went multipolar

- The Chinese scientist who sequenced covid is barred from his lab

- Who Are the Israeli Hostages Released by Hamas?

- Latin America is under authoritarian threat

- Narendra Modi and Xi Jinping meet and resolve a border row

- Best Internet Providers in Boise, Idaho

- Where democracy is most at risk

- Does Perplexity's "answer engine" threaten Google?

- China plans to crash a spacecraft into a distant asteroid

- Political turmoil is tearing Peru apart

- Climate change is making the monsoon more dangerous

- How Taiwan is shaped by its history and identity

- How strongmen abuse tools for fighting financial crime

- Are American children's books getting more "woke"?

- What next for Pakistan?

- Hagan Scotten, Emil Bove and the Collective Punishment Test

- Obituary: George Holliday fortuitously filmed the beating of Rodney King

- Frank Drake believed that the universe had to contain other intelligent beings

- The pandemic's toll on schooling emerges in awful new exam results

- Illegal gold is booming in South America

- A history-lover's guide to the market panic over AI

- China is backing opposing sides in Myanmar's civil war

- Satellite data show Ukraine's forces are testing Russia's defences

- Nominate your invertebrate species of the year

- The World Bank is struggling to serve all 78 poor countries

- Mexico's foreign policy is unambitious and erratic

- The Rachel Reeves theory of growth

- Is America Inc's war for talent over?

- Apple can't do cars. Meet the Chinese tech giants that can

- AUKUS enters its fifth year. How is the pact faring?

- Will war snuff out the Gulf's global business ambitions?

- Turkey could soon strike a historic peace deal with the Kurds

- Why everyone wants to lend to weak companies

- Elon Musk is failing to cut American spending

- Checks and Balance newsletter: Does the vice-president matter in an election?

- The shortfall in British adoptions

- Can IKEA disrupt the furniture business again?

- Few countries are better placed than Vietnam to get rich

- Saros is the next game from Housemarque, coming to PS5 in 2026

- Startups are finding novel ways to recycle carbon

- The Quad finally gets serious on security

- Economic data, commodities and markets

- The weekly cartoon

- From Swipe to Sweat: How Athletic Clubs Replaced Dating Apps

- Do rising methane levels herald a climate feedback loop?

- China is writing the world's technology rules